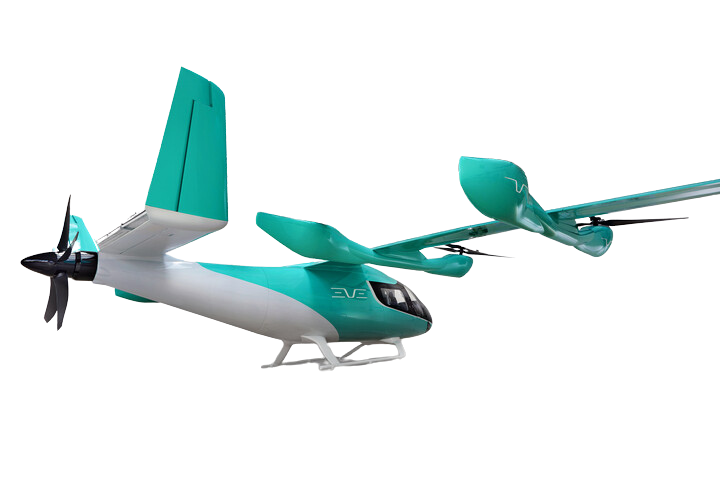

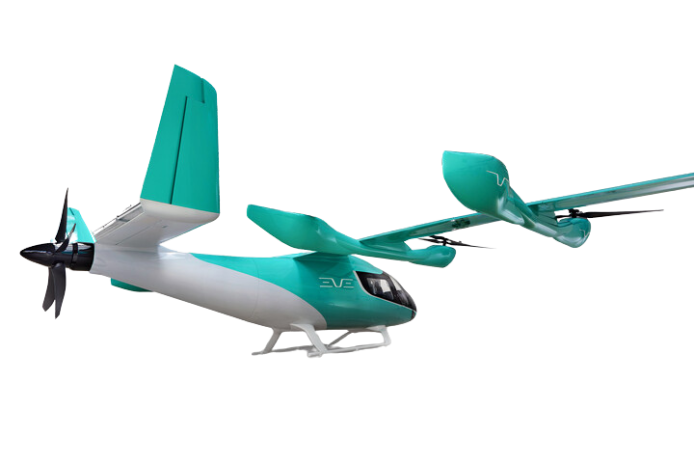

The electric vertical take-off and landing sector is set to transform urban mobility.

The electric vertical take-off and landing (eVTOL) market is growing rapidly. Eve Air Mobility’s inaugural Global Market Outlook predicts an in-service vehicle fleet of 30,000 eVTOLs by 2045. This fleet figure will be needed to support an estimated three billion passengers, creating a potential revenue of $280 billion. To underline its figures, Eve has announced its first binding framework agreement with Revo, an advanced air mobility (AAM) operator headquartered in São Paulo, Brazil, and its parent company, Helicopters International SA (OHI). The contract includes the purchase of up to 50 eVTOLs, associated entry into service and aftermarket services.

Eve has Letters of Intent (LOI) with 29 clients, the latest being Aerosolutions and Bluenest by Globalvia, which intends to purchase up to 50 aircraft for the Costa Rica market. In total, Eve has LOIs for nearly 2,900 aircraft.

This sector will ramp up quickly and air navigation service providers (ANSP) need to prepare for scale. Certain markets will have a lot more eVTOLs than others but there will be a demand for them in many urban environments around the world, for intra-city transfers and for tourism.”

Rob Weaver, Head of Business Development (Air Traffic Management and Oceania), Eve Air Mobility.

Entry into service

Eve presented its full-scale mock-up at the Paris Air Show, and the company will have up to six conforming prototypes for the flight test campaign. Assuming tests over the next two years proceed as planned, certification by the National Civil Aviation Agency of Brazil (Agência Nacional de Aviação Civil) and entry into service are expected in 2027.

But it is the infrastructure that holds the key to success. The economics of eVTOL operations require a high utilisation rate – up to 15 short duration missions a day – meaning what happens on the ground and in the sky is critical.

In terms of air traffic management (ATM), eVTOLs can operate like civil aircraft using traditional systems and processes much like helicopters. “But there will soon be a need for technology and services that ensure flow management as more eVTOLs take to the skies, because the aircraft will need to know there is a place to land and airborne holding must be minimised,” says Weaver.

In some countries, eVTOL operations are likely to be managed by the ANSP. Japan has indicated that this is its preferred way forward, for example. Other countries, such as the UK, have opted for open architecture, allowing third parties to offer a service.

“We are working to ensure suitable route structures, and the necessary flight planning and air traffic support tools are in place for the launch of operations,” says Weaver. “But these efforts will mature quickly, and we’ll soon see a need for new ATM automation and separation services to support scale. We want to work on these challenges to ensure the industry is not constrained.”

Having sufficient capacity on the ground may be more problematic. Land will not be easy to find in the locations that eVTOL service will target but vertiports – eVTOL airports – will be essential if the eVTOL sector is to deliver on its ambitions.

Companies are stepping up, however. A vertiport is being built in Dubai and there are meaningful developments elsewhere. “It is critical that we maximise ground infrastructure utilisation,” says Weaver. “It’s not so much about having vast vertiports or landing locations in every suburb but about optimising the use of the ground infrastructure that is available. Information sharing between eVTOL operators, vertiports and ATM is the key.”

Data exchange will also be vital to ensuring eVTOLs maintain aviation’s enviable safety record. Electric propulsion and the associated systems are new and that makes safety critical. Alternate planning must become second nature, says Weaver. Where will eVTOLs land if airspace is closed or the aircraft can’t land at the destination vertiport?

“The flight plan and operational status will need to be disseminated to all parties,” he adds. “That way, vertiports will get real-time information, plan operations accordingly and manage delay and disruption. That doesn’t happen so much with helicopters.”

Energy management regulations are also being studied and there will undoubtedly be a reserve for the battery charge in the same way there is for jet fuel in conventional aircraft. But Weaver says the guidelines to solve these challenges will likely be adapted from existing paradigms.

Eve has also introduced TechCare, an all-in-one service portfolio for eVTOLs, backed up by parent company, Embraer. This includes Vector, an air traffic management solution. The whole package includes managing take-off and landing schedules, fleet planning, and traffic control.

A comprehensive materials services portfolio and digital solutions for parts ordering ensure 24/7 support to operators and MROs across a global network, addressing a critical need for readily available components.

Eve has selected BAE Systems, a company with a long and distinguished history of innovation in aerospace and defence, to provide the battery system for Eve’s electric aircraft. Their comprehensive solution ensures battery availability and streamlines logistics, giving operators peace of mind in their operations.

As part of Embraer’s global service centres, operators worldwide can access Eve’s services, a unique offering in the competitive landscape.

Leveraging Embraer-CAE Training Services, Eve provides access to global training centres staffed by aviation experts, addressing a critical need in the rapidly growing UAM industry

Close

“We also need to understand how the ANSPs think and the plans they have in place to develop their services over the next decade or two. If we can do that and ensure an aligned vision, then our future skies will have safe and sustainable eVTOL operations.”

Rob Weaver, Head of Business Development (Air Traffic Management and Oceania), Eve Air Mobility.

Weaver accepts that there are plenty of challenges ahead, including regulatory approval and airspace integration. But he insists that the outlook is positive.

“We are talking about a major transformation and so what has been achieved already should not be underestimated,” he says. “But for the next steps in eVTOL operations management, a roadmap agreed by all parties would be especially useful. All players, including ANSPs, need to be clear about how ATM services and technology will evolve and what will need to be done to accommodate them.

Safety

The electric vertical take-off and landing sector is set to transform urban mobility.

The electric vertical take-off and landing (eVTOL) market is growing rapidly. Eve Air Mobility’s inaugural Global Market Outlook predicts an in-service vehicle fleet of 30,000 eVTOLs by 2045. This fleet figure will be needed to support an estimated three billion passengers, creating a potential revenue of $280 billion. To underline its figures, Eve has announced its first binding framework agreement with Revo, an advanced air mobility (AAM) operator headquartered in São Paulo, Brazil, and its parent company, Helicopters International SA (OHI). The contract includes the purchase of up to 50 eVTOLs, associated entry into service and aftermarket services.

Eve has Letters of Intent (LOI) with 29 clients, the latest being Aerosolutions and Bluenest by Globalvia, which intends to purchase up to 50 aircraft for the Costa Rica market. In total, Eve has LOIs for nearly 2,900 aircraft.

This sector will ramp up quickly and air navigation service providers (ANSP) need to prepare for scale. Certain markets will have a lot more eVTOLs than others but there will be a demand for them in many urban environments around the world, for intra-city transfers and for tourism.”

Rob Weaver, Head of Business Development (Air Traffic Management and Oceania), Eve Air Mobility.

Entry into service

Eve presented its full-scale mock-up at the Paris Air Show, and the company will have up to six conforming prototypes for the flight test campaign. Assuming tests over the next two years proceed as planned, certification by the National Civil Aviation Agency of Brazil (Agência Nacional de Aviação Civil) and entry into service are expected in 2027.

But it is the infrastructure that holds the key to success. The economics of eVTOL operations require a high utilisation rate – up to 15 short duration missions a day – meaning what happens on the ground and in the sky is critical.

“We are working to ensure suitable route structures, and the necessary flight planning and air traffic support tools are in place for the launch of operations,” says Weaver. “But these efforts will mature quickly, and we’ll soon see a need for new ATM automation and separation services to support scale. We want to work on these challenges to ensure the industry is not constrained.”

In terms of air traffic management (ATM), eVTOLs can operate like civil aircraft using traditional systems and processes much like helicopters. “But there will soon be a need for technology and services that ensure flow management as more eVTOLs take to the skies, because the aircraft will need to know there is a place to land and airborne holding must be minimised,” says Weaver.

In some countries, eVTOL operations are likely to be managed by the ANSP. Japan has indicated that this is its preferred way forward, for example. Other countries, such as the UK, have opted for open architecture, allowing third parties to offer a service.

Energy management regulations are also being studied and there will undoubtedly be a reserve for the battery charge in the same way there is for jet fuel in conventional aircraft. But Weaver says the guidelines to solve these challenges will likely be adapted from existing paradigms.

Eve has also introduced TechCare, an all-in-one service portfolio for eVTOLs, backed up by parent company, Embraer. This includes Vector, an air traffic management solution. The whole package includes managing take-off and landing schedules, fleet planning, and traffic control.

Data exchange will also be vital to ensuring eVTOLs maintain aviation’s enviable safety record. Electric propulsion and the associated systems are new and that makes safety critical. Alternate planning must become second nature, says Weaver. Where will eVTOLs land if airspace is closed or the aircraft can’t land at the destination vertiport?

“The flight plan and operational status will need to be disseminated to all parties,” he adds. “That way, vertiports will get real-time information, plan operations accordingly and manage delay and disruption. That doesn’t happen so much with helicopters.”

Having sufficient capacity on the ground may be more problematic. Land will not be easy to find in the locations that eVTOL service will target but vertiports – eVTOL airports – will be essential if the eVTOL sector is to deliver on its ambitions.

Companies are stepping up, however. A vertiport is being built in Dubai and there are meaningful developments elsewhere. “It is critical that we maximise ground infrastructure utilisation,” says Weaver. “It’s not so much about having vast vertiports or landing locations in every suburb but about optimising the use of the ground infrastructure that is available. Information sharing between eVTOL operators, vertiports and ATM is the key.”

A comprehensive materials services portfolio and digital solutions for parts ordering ensure 24/7 support to operators and MROs across a global network, addressing a critical need for readily available components.

Eve has selected BAE Systems, a company with a long and distinguished history of innovation in aerospace and defence, to provide the battery system for Eve’s electric aircraft. Their comprehensive solution ensures battery availability and streamlines logistics, giving operators peace of mind in their operations.

As part of Embraer’s global service centres, operators worldwide can access Eve’s services, a unique offering in the competitive landscape.

Leveraging Embraer-CAE Training Services, Eve provides access to global training centres staffed by aviation experts, addressing a critical need in the rapidly growing UAM industry

Rob Weaver, Head of Business Development (Air Traffic Management and Oceania), Eve Air Mobility.

“We also need to understand how the ANSPs think and the plans they have in place to develop their services over the next decade or two. If we can do that and ensure an aligned vision, then our future skies will have safe and sustainable eVTOL operations.”

Weaver accepts that there are plenty of challenges ahead, including regulatory approval and airspace integration. But he insists that the outlook is positive.

“We are talking about a major transformation and so what has been achieved already should not be underestimated,” he says. “But for the next steps in eVTOL operations management, a roadmap agreed by all parties would be especially useful. All players, including ANSPs, need to be clear about how ATM services and technology will evolve and what will need to be done to accommodate them.